WEEE Regulations

The Regulations

The original WEEE Regulations started in 2007. Because of a recast of the EU Directive, the UK was required to implement new Regulations by February 2014. Following extensive consultation, the new Waste Electrical and Electronic Equipment Regulations 2013 were published in December 2013 and came into effect on 1 January 2014.

New Guidance was issued by the government on 17 March 2014.

The WEEE (Amendment) Regulations 2015 clarified the position with regards PCS DCF obligations and also added in mid-year change requirements.

The Waste Electrical and Electronic Equipment (Amendment) (No. 2) Regulations 2018 apply the Producer Balancing System

The Waste Electrical and Electronic Equipment (Amendment, etc.) Regulations 2025 apply the new requirements for online market place operators and vapes

A new DCF Code of Practice has also been published (24th September 2025)

A new EU FAQ has been issued although as of Sept 2014, the UK has not accepted some aspects of this, most noticably, printer cartridges and household luminaires being in scope. Defra’s position on this document is that the EA Scope Guidance forms the current position that UK businesses should adopt and has accepted the revised definition of B2C to include EEE that is likely to be used by both businesses and private households – ‘dual use’. This was adopted from 1 January 2015 with all EEE placed on the market in 2014 reported under this new definition. Guidance on determining dual use classification is provided here.

Are you affected?

You are classed as a PRODUCER if your business places electrical equipment (EEE) onto the UK market – either for business use or for household use – through UK manufacture, import in to the UK or by selling equipment manufactured by someone else that is sold under your own brand. (A recent change of view by the EA classes imports that are the re-exported as NOT being placed on the UK market – see Guidance Note)

‘Placed on the market’ is defined in the EU ‘Blue Book‘.

If you place less than 5 tonnes of EEE onto the UK market in a calendar year, you are classed as a SMALL PRODUCER under the revised Regulations and must register direct with one of the environmental Agencies by 31st January.

You are considered to be a DISTRIBUTOR under the Regulations if your business sells EEE to consumers (not businesses), either direct from shops or indirect through the internet or catalogues.

The Environment Agency has produced a Guidance document to help define what counts as EEE and WEEE. However, it should be noted that SEPA’s definition requires all used EEE to be classed as waste and to be handled under waste regulations whereas the EA allows asset management to be carried out without the used EEE ever having to be described as waste.

The EC has produced EU Correspondents Guidelines for waste shipment which give a good basis for determining what is used EEE or WEEE in Appendix 1.

What must you do?

If you are a DISTRIBUTOR, you have a choice. You can opt to offer in-store takeback of goods free of charge – in which case you must display signs in the shop or on your website to say that you do this – or you must register with the Distributor Takeback Scheme. This exempts you from in-store takeback, but you will be required to pay a fee for this exemption. Under either option, you must display notices in-store advising customers about environmental issues related to waste EEE (WEEE). Details.

If your store has a floor area greater than 400m2 relating to the selling of electrical equipment, then you must receive back any small WEEE free of charge regardless of whether the person bringing it to the store buys any new goods from you. However again, you are exempt from this if you register with the DTS.

If you are a PRODUCER and place EEE onto the UK market, you must register. There are two levels of registration.

- Producers placing more than 5 tonnes a year of EEE onto the UK market must register through a Producer Compliance Scheme (PCS).

- Producers placing less than 5 tonnes a year onto the UK market, are classed as SMALL PRODUCERS and have the option to register with a PCS or to register direct with one of the 4 environmental Agencies (EA, SEPA, NIEA, NRW). Small Producers that choose this option have no responsibilities for financing the collection and treatment of household WEEE, but still have the same responsibilities as large producers for non-household WEEE. Registration can be carried out online here.

Each compliance period is a calendar year. Producers have to register with a scheme by 15th November for the year ahead whilst small producers do not have to be registered until 31st January. Registration requires company information and for small producers, data for EEE placed on the market in the previous year. Large producers are required to supply data to their Compliance Scheme each quarter. Every registered producer is given a Producer Registration Number by the Agency which they keep year on year. Under Regulation 22, producers should declare this to any distributor they supply although there is no prescribed format. The EA keep a public register of registered producers.

(*The Agency definition of ‘placed on the market’ comes from the EU Blue Book page 18 and revolves around the expression ‘being made available to’. In their view, therefore, if a product is imported into the UK or sits on a manufacturer’s shelves in stock with the option in both cases of the product remaining in the UK, it has been ‘placed on the market’ even if the product is then exported. This is clearly nonsensical as the WEEE Regulations are all about dealing with products that become WEEE in the UK. Nevertheless, that is the EA’s current position).

As well as registering, producers must also ensure that all their products are marked with the crossed out wheelie bin symbol and with their Producer Identification Mark which identifies their company as the producer. Generally, this is the company logo.

It is an offence to place EEE on the UK market and not be registered. Overseas companies selling to end users in the UK must now register through an Authorised Representative. This is a person or business resident in the UK that then takes on the legal liabilities of the of a producer on behalf of the overseas company.

How the system works

- Producer Compliance Schemes (PCS) will register their members for the following year by 15 November.

- They will report the final data for their current year members by 31 January.

- Local Authorities (LA) can decide to ‘opt out’ of the collection of one or more WEEE streams (where they believe they will get better value for doing so) and must inform Defra by 31 January of their intention to do so with expected weights. All WEEE collected by opt-out LAs must go to a Authorised Accredited Treatment Facility and will have no evidence trading value.

- Defra will calculate household WEEE collection targets by 31 March These will then be apportioned to PCSs on a market share basis giving them the tonnage of household WEEE they must collect in the Compliance Period.

- A PCS must then collect the WEEE equivalent to their target by the end of the year and provide evidence to the relevant Agency by 31 January that they have done so.

- Evidence is only valid where it relates to WEEE that has been delivered in by a PCS and will only be allocated to that PCS.

- Evidence trading is not permitted. If a PCS over or under collects, it can contract with an over collecting scheme to take responsibility for the collection of what it needs.

- A Compliance Fee will is set in February for the previous compliance year by an organisation approved by the Government which will determine a fee that can be paid by those that have under collected.

- Under-collecting PCSs will have the option of paying the Compliance Fee. Those with surpluses and those with shortfalls will therefore have the gamble of wondering whether to wait for the CF to be set or whether to agree terms.

- At the end of the year, a PCS can demonstrate compliance by either sufficient physical evidence or Compliance Fee payments.

- Money from the CF will go to environmental causes.

- A PCS left with having collected too much evidence will only have the option of recovering cost through its members.

Overview

The new Waste Electrical and Electronic Equipment Regulations 2013 came into effect on 1 January 2014, replacing the previous Waste Electrical and Electronic Equipment Regulations 2006 which came into force in January 2007 and were subject to Amending Regulations in 2007 and further Amending Regulations in 2010.

They are the UK’s implementation of the 2012 EU WEEE Directive and come under the responsibility of Defra. There are approximately 6,500 businesses registered as producers through 34 compliance schemes. Defra have issued a Guidance Document (dated March 2014) that has no legal authority, but which is the basis for much of the interpretation of the Regulations. The EU has a WEEE FAQ which is also very useful.

The Regulations apply very different responsibilities to producers for EEE supplied for non-household use (B2B) and EEE supplied for household use (B2C). The former applies more direct responsibility to producers in relation to who they supply whereas the latter works under a collective market share approach. B2B includes non-commercial organisations such as the public sector, charities etc.

B2C (business to consumer)

The main focus of the Regulations is on EEE sold for household use. Based on their market share from their previous year’s data for EEE placed on the market, producers are responsible for the costs of collection, treatment and recycling of a fixed proportion of the target tonnage set by Defra. This responsibility is aggregated by PCSs for their members.

The data has to be reported under 14 categories (see below). This therefore means that producers have to work out which category their EEE fits in. Much of it is obvious, but there are many items that could sit in a number of categories. Producers have to calculate and report the weight of the products they have placed on the market on a quarterly basis so that their PCS can send it to the Agency by the end of the month following the quarter.

Data also has to be reported by schemes and treatment facilities on the same quarterly basis to the Agency for all WEEE that has been collected. This will relate primarily to three sources of WEEE :

- Local authority civic amenity sites that have registered as Designated Collection Facilities (DCFs).

- WEEE collected by the big retailers when they deliver new appliances.

- WEEE collected from households.

PCSs must collect sufficient WEEE to meet their targets in each Category although any Category 2-10 evidence can be used to satisfy any Category 2-10 obligation.

Under the previous system, a PCS that failed to collect sufficient WEEE to meet its obligation HAD to buy from other schemes to make up the difference. However, the Regulations do not now allow evidence trading although PCSs can agree to trade collection tonnages. This means that before evidence is registered, a PCS needs to ensure it is needed.

The Regulations provide a balancing system – the Compliance Fee. Where a PCS does not have sufficient evidence, it can choose to pay a Compliance Fee for each shortfall tonne. However, the CF does not get set until February for the previous compliance year, so a PCS has to consider whether it will be cheaper to agree an arrangement with another PCS or wait to see what the CF will be set at for each category.

Where a PCS is left with surplus tonnage at the end of the year, it now has no evidence value and the PCS is left with the costs it has incurred.

This might suggest that PCSs will be cautious about taking on DCFs and that some Local Authorities may therefore be left without their WEEE being collected. However, the Regulations enable a LA to demand that a PCS collects their WEEE regardless of whether the PCS needs it and a Producer Balancing System has been set up by Producer Compliance Schemes to share the costs where this occurs.

Local Authorities may opt to manage their WEEE themselves where they feel they will get a net value for it. This generally will only apply to Large Domestic Appliances and perhaps Small Mixed WEEE in some cases, but if they take up this option, they must inform Defra by 31 January and indicate the expected tonnage that will be managed in this way. For the rest of the Compliance Period, the LA must then ensure that the WEEE they control gets taken to an AATF and reported, but there will be no evidence issued for it. Instead, Defra will use the estimated tonnage as part of the substantiated estimates they deduct from the category prior to apportioning the remaining tonnage to PCSs.

B2B

The WEEE Regulations impose two different responsibilities on producers for B2B WEEE depending on whether the WEEE is ‘historical’ or ‘new’. ‘Historical’ WEEE is classed as EEE that was placed on the UK market prior to August 15 2005. ‘New’ WEEE relates to EEE that has been placed on the market since that date. In theory, all ‘new’ WEEE should be marked with the crossed out wheelie bin symbol to identify it.

For ‘historical’ WEEE, producers have a responsibility, when they provide new equipment to a business, to take away, treat and recycle like-for-like WEEE free of charge. Therefore, if a printer manufacturer supplies ten new printers to a business, it must offer to take away 10 old ones, regardless of brand. If the business has twenty old ones, then the end-user business has responsibility for the disposal of the other ten.

For ‘new’ WEEE, producers have responsibility for their own brand. In theory, a business wanting to dispose of a printer that has the crossed out wheelie bin can request the brand owner to collect it free of charge and then deal with the disposal although Defra have stated that producers only have responsibility to collect free of charge from a collection point. So for ‘new’ WEEE, it should be as follows:

- End user wants to dispose of a large plasma screen TV.

- They look at the brand, go to the Environment Agency website, go to the public register, look up the brand name and see which scheme it belongs to.

- They then ring the scheme who tells them to take the TV to collection point X where it will be received under the scheme’s name. The scheme will then organise for the TV to be collected, treated and recycled and pass the bill back to their brand member.

B2B WEEE is therefore, in theory, covered. However, the reality is that most businesses will either store something if it stops working or organise disposal themselves by calling a waste management company.

Treatment

The Regulations require all WEEE to be treated through an Authorised Treatment Facility (ATF), but WEEE collected under the responsibilities of producers must go to an Approved Authorised Treatment Facility (AATF) which must then register evidence of treatment through a Defra-run body called the Settlement Centre. This is used to record the amount of either type of WEEE that has been treated.

AATFs and Authorised Exporters must gain accreditation each year through the relevant Agency. (Guidance Notes here)

There is EWC classification Guidance for WEEE on GOV.UK.

PLEASE NOTE THAT RECENT ANALYSIS HAS CONFIRMED THE PRESENCE OF POPS IN MOST WEEE PLASTIC. NEW GUIDANCE (JUNE 2020) HAS BEEN ISSUED ON THE CLASSIFICATION OF WEEE IN RELATION TO POPS. PLEASE SEE SECTION AT THE BOTTOM OF THIS PAGE.

Individual items generally considered to be hazardous include Fluorescent tubes, laptops, CRT and LCD based television screens and monitors, fridges and freezers, items containing mercury and lead, mercury and NiCd batteries.

Targets

The WEEE Directive imposes collection targets.

- By the end of 2016, 45% of the average of what was placed on the market in the previous two years must be collected, treated and recycled.

- By the end of 2019, this figure rises to 65%.

It is the Member States’ responsibility to achieve this which is why Defra have had to change the Regulations to ensure that PCSs collect enough for the UK to meet the target, taking substantiated estimates of other WEEE into account.

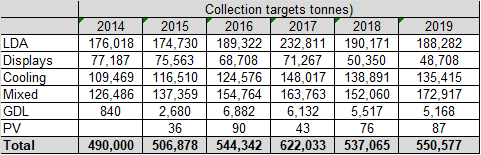

Each year, Defra sets specific household WEEE collection targets for each category although evidence for any of the categories 2-10 (Small Mixed WEEE – SMW) can be used to satisfy the sum of the SMW target.

LDA = Large Domestic Appliances (Cat 1)

Mixed = Small Mixed WEEE (Cats 2-10)

GDL = Gas Discharge Lamps that now includes LEDs (Cat 13)

PV = Photovoltaic Cells (Cat 14)

All collected WEEE has to go for reuse or be treated and must meet recycling and recovery targets. Meeting these targets is the responsibility of the AATFs. Previously, this would be verified through Independent Audit Reports, but this requirement has now been removed.

Sites wishing to become accredited must apply before the end of September to guarantee approval by 1 January.

The targets are as follows (GOV.UK)

| Category | Recovery target | Reuse & Recycling target |

| 1&10 | 85% | 80% |

| 3&4 | 80% | 70% |

| 2,5,6,7,8&9 | 75% | 55% |

| GDL | n/a | 80% |

Where the mixed WEEE protocol is used, the targets can be met on a mass balance basis. For the new protocols, that equates to:

Recovery – 73.94% Recycling – 65.24% of the total

Scope

The WEEE Regulations apply to any equipment that requires electrical current – from batteries or mains – to perform its primary function. Therefore, a teddy bear with a tape recorder built in would be in scope, but a teddy bear that just says ‘goodnight’ would not. This is because the electric current performs an important function in the use of the product in the first example, but it does not in the second.

There are certain EU specific exemptions.

- Items using more than 1,000 volts AC or 1,500 volts DC

- Equipment designed and used purely for military purposes

- Large scale industrial equipment eg a floor mounted lathe

- Equipment that forms part of a non-electrical product eg a timer in a gas installation

- Household lighting equipment

- Large scale fixed installations eg an alarm system installed by a professional

Guidance (v4.1 Oct 2012) has been produced by the Agencies to help define what is and isn’t EEE and what should be classed as B2B and B2C. It is a ‘living’ document, mainly for internal use, but it includes some fairly fundamental changes to what had previously been considered out of scope but which must now be considered in scope and reported. These include:

- There has been a tightening of the ‘primary function’ requirement to include ‘it is sold based on the idea that the functions that depend on electricity to work add an important feature and value to the product’ although the Guidance still states that novelty items such as singing greetings cards or flashing ties are out.

- Any sports equipment which has an electrical item attached, even if it is not integral to the working of the equipment, is in scope. Eg a fitness cycle with an electric timer.

- Items sold as ‘finished products’ are in regardless of whether they are then fitted to another product eg antennae, connecting cables, sound cards, keyboards, computer mouse.

- Car stereos sold separately but which are then fitted and wired into a car are out as they will be with the car at end of life. But after market sat navs, DVD players etc which are portable are in.

- All household lighting – internal and external – is out other than gas discharge bulbs and tubes. Torches, however, are in and should be reported under Category 2 as are sunbeds which should be reported under Category 2 whilst the sunbed lamps are reported under Category 5.

- Large scale industrial tools have been more clearly defined. Any single, stand alone tools – lathe, pallet wrapping machine etc – is in, regardless of whether it is fixed. Only those items that are a combination of several pieces of equipment, systems, finished products or components designed to be used in an industrial environment only, are put together by an assembler or installer at a given place and designed to be permanently fixed; and are put together at a given place to be used in a specific environment to perform a specific task. Are out of scope – eg windfarms, production lines, oil rigs!!

- Household furniture with an electrical function is out, strangely even though that contradicts 1. above.

- Chip and pin and credit cards are out, but memory cards, SIM cards, RFID and any other tracking devices are in.

- Wind up electrical items are in.

A more limited Scope Guidance document was placed on GOV.UK in 2014 that would seem to supersede v4.1 which is not available on GOV.UK, but 4.1 still provides a much more comprehensive explanation on determining what is and isn’t in scope.

There is new Guidance (Feb 2015) on GOV.UK which lays out the process to determine whether items should be classed as B2C or B2B. Effectively, the default position is that where there is any ambiguity, the items should be considered to be B2C. Anything sold for home offices, therefore, should be considered as B2C. At the end of the day, the Regulations state that it is the responsibility of the producer to determine whether something is in scope. So long as the producer has a valid reason for deciding it is out of scope based on the above criteria, the Agency can only challenge the decision – ultimately in the courts – if it disagrees.

The EU Directive divides EEE and WEEE into 10 categories. The UK has chosen to pull cooling equipment out of Category 1, Display equipment out of categories 3&4 and gas discharge lamps out of category 5 to create an additional 3 categories. For 2014 onwards, there is also a new Category 14 – Photovoltaic cells – and have widened Category 13 to include LED bulbs. Producers must therefore decide which category to list their equipment under from the following:

- Large household appliances (e.g. white goods less cooling equipment);

- Small household appliances (e.g. vacuums, irons, toasters etc.);

- IT and telecoms equipment (e.g. computers, printers, calculators, phones, answer machines etc. but not displays);

- Consumer equipment (e.g. radios, hi-fi equipment, electronic musical instruments etc.but not televisions);

- Lighting equipment (but not household lighting)

- Electrical and electronic tools (e.g. drills, saws, sewing machines etc., but excluding large stationary industrial tools);

- Toys and leisure and sports equipment (e.g. train sets, video games, coin slot machines etc.);

- Medical devices (e.g. dialysis machines, ventilators etc.) (Note that this category is not covered by the RoHS Directive at present – see below.);

- Monitoring and Control instruments (e.g. smoke detectors, thermostats etc.) (Note that this category is also not covered by the RoHS Directive at present.); and

- Automatic dispensers (e.g. ATMs, vending machines etc.).

- Display equipment (e.g. TVs and monitors)

- Cooling equipment (e.g. refrigeration equipment)

- Gas discharge lamps and LEDs

- Photovoltaic cells

Where WEEE is collected mixed from DCFs, a protocol can be applied to simplify the calculation of the tonnage of each category that evidence can issued for in relation to the mixed load. A calculator is have been produced by 360 here.

The percentages are as follows:

Category 1 – 12.6%

Category 2 – 22.37%

Category 3 – 21.78%

Category 4 – 22.3%

Category 5 – 0%

Category 6 – 12.24%

Category 7 – 1.47%

Category 8 – 0%

Category 9 – 0.02%

Category 10 – 0%

Category 11 – 0.95%

Category 12 – 0.19%

Category 13 – 0%

A full explanation of the protocol and the how evidence should be issued has been published in GN04: WEEE Evidence and National WEEE Protocols Guidance (updated Feb 2013 with v3.1).

AATFs and AEs must be accredited to issue evidence using the WMP5 accreditation form.

AATFs and AEs must complete Quarterly Returns and have produced separate Guidance on how to do this.

EWC Codes for WEEE are shown here.

Retailer responsibilities

Retailers of electrical equipment are confusingly know as ‘distributors’. Distributors are responsible for providing ‘an adequate network’ of free disposal facilities to consumers for B2C WEEE. This responsibility is discharged through two methods:

- Distributors can sign up to the Distributor Takeback Scheme run by Valpak. This attracts a fee which is used to fund Local Authorities to enhance their Civic Amenity sites to accept the different groups of WEEE. Signing up to the DTS exempts a distributor from having to take back anything in store.

- Distributors can elect to offer free of charge in-store takeback. They would have to offer to take back on a one-for-one basis, any product of a similar type sold by them eg if they sold DVD players, they would have to take back cassette players. This requirement applies whether products are sold in a store, delivered to a customers premises or sold on-line. If this option is taken, stores – and on-line sellers through the website – must display notices to say that in store takeback is offered. Under the new Regulations, if a distributor is not part of the DTS, it must also offer free take-back for any item with a dimension no greater than 25cm regardless of whether they are selling something new to the person bringing it in.

Whatever option is taken, distributers also have a requirement to display information about the environmental impact of WEEE and how it can be recycled. Details of what should be displayed can be found on the website of the VCA who police the retailer responsibilities.

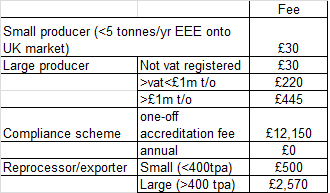

Fees

The Regulations apply a scale of fees that must be paid to the appropriate Agency each year on registration. These will be charged by a Producer Compliance Scheme in addition to their membership fees. A consultation and are as follows:

- For companies registering through a PCS with a total UK turnover (regardless of whether that turnover relates to imports, exports, UK manufacture, electrical equipment or any non-electrical equipment):

- Small Producers (<5 tonnes per annum) – £30/annum

- Less than the VAT threshold and not registered for VAT – £30/annum

- Registered for VAT but below £1m turnover in the last financial year – £220/annum

- Above £1m turnover in the last financial year – £445/annum

- For Small Producers registering direct with the appropriate Agency – £30/annum.

- In addition, a PCS is required to pay an initial accreditation fee of £12,150.

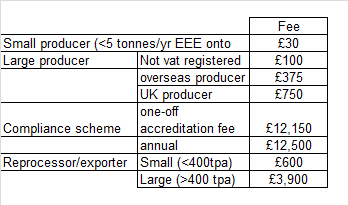

In 2017, the Environment Agency consulted on revised fees which are due to be implemented from 1 January 2019 for England only. The rest of the UK will continue with the current fees.

Table 1. This is a summary of the fees that are applied to producers, PCSs, reprocessors and exporters across the whole UK in 2018 and in all but England from 1 January 2019.

Table 2. This is a summary of the fees to be charged in England from 1 April 2019 by the Environment Agency.

Schemes will then charge additional fees in relation to membership and the cost of evidence. Evidence costs will tend to vary significantly between schemes as they will relate more to the actual costs of collection and treatment than to the supply and demand position (unlike Packaging PRNs). Therefore, a scheme that is collecting WEEE from high cost rural DCFs might be more expensive than one collecting from urban sites. There is also considerable differences in the mark up applied by schemes with some charging for evidence at cost and others adding a significant margin, so it pays to shop around.

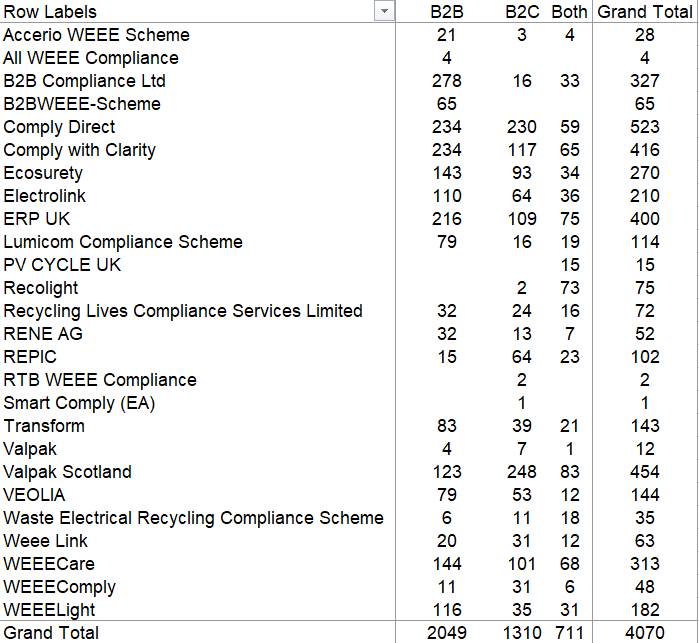

Producer Compliance Schemes

26 Producer Compliance Schemes are now registered under WEEE (8 Jan 2021)

The public register lists 4070 registered producers split between the schemes and direct registration for 2019.

WEEE Exports

The export of WEEE is highly controlled and is explained very well in this document – EU Correspondents Guidelines – where there is also good clarification on what is considered used EEE as opposed to WEEE for the purposes of export. Further information on exports is found in the Transfrontier Shipment section.

WRAP has produced useful guidance on the Export of WEEE and WEEE Derived Materials.

The recast Directive and 2014 UK Regulations have tightened up on the requirements for the export of used EEE. Schedule 9 lays out the minimum requirements which are not dissimilar to the export of waste EEE and apply much more rigorous controls.

Current situation

The WEEE Regulations are due to be reviewed towards the end of 2020.

POPs in WEEE

Recent (2019) testing of WEEE has identified that there are levels of Persistent Organic Pollutants (POPs) in WEEE plastic well above the thresholds allowed under EU controls.

The UK applies POPs through the EU regulations that were in place at the time of Brexit. Annex V states that only the following recovery and disposal operations are permitted for POPs waste – D9, D10 R1, R4.

Guidance on the classification of WEEE containing POPs has now been published by the EA and should be taken into consideration in assessing the correct EWC code. Broadly, it leaves all WEEE classified as hazardous on collection other than LDA. Outputs from WEEE treatment facilities must be assessed for POPs content with POPs-containing plastic requiring destruction by high temperature incineration.

The following are the guidance documents that were published in June 2020:

- Classify different types of waste – overview

- Classify different types of waste – WEEE

- Classify some waste electrical devices, components, and wastes from their treatment

- Identify and dispose of waste containing persistent organic pollutants

On 27 August 2020, the EA sent out an explantory letter to over a thousand operators in England that might be affected. The other Agencies are understood to be planning to do something similar.

WEEE links

GOV.UK – distributors/retailers

GOV.UK – evidence and protocols

GOV.UK – WEEE EWC Classification

Environment Agency – 08708 506 506

SEPA – 01786 457700

NIEA – 028 90 546 408

Producer Responsibility

- Overview

- WEEE Regulations

-

- Data

- Used EEE exports

- Packaging Waste Regulations

-

- Packaging Obligation Calculator

-

- PRN Prices

-

- Data

-

- Agency Communications

- Extended Producer Responsibility (EPR)

- Essential Requirements

- Batteries Regulations

- End of Life Vehicle Regulations

- Agency Comms

- Plastic Packaging Tax

- Deposit Return Scheme (DRS)