Landfill Tax

Are you affected?

All general and construction waste attracts one of the two rates of landfill tax. The cost of your waste collection service, regardless of how much gets sorted and recycled, will generally be influenced by the rate of landfill tax,

Summary

The Landfill Tax was introduced in 1996 by the Treasury as an environmental tax to help reduce the amount of waste going to landfill. At the time, there was a claim that it would not lead to an increase in costs for industry as NI was reduced at the same time, but it has since become disconnected from that argument and has steadily risen as an incentive to try to reduce landfill and encourage recycling.

The Tax is split into two bands. A lower band is applied to inert waste that contains no biodegradable material, whilst all other general waste has the standard band applied. Certain wastes are exempt – dredgings from inland waterways and harbours, contaminated land under certain circumstances, waste from mining and quarrying and waste that is used for long-term engineering purposes on a landfill site amongst others. The full list can be found in para 4 here.

HMRC documents and Guidance is available here.

Landfill Tax is common around Europe, but rates vary hugely. A 2014 survey can be found here.

Landfill Tax increases

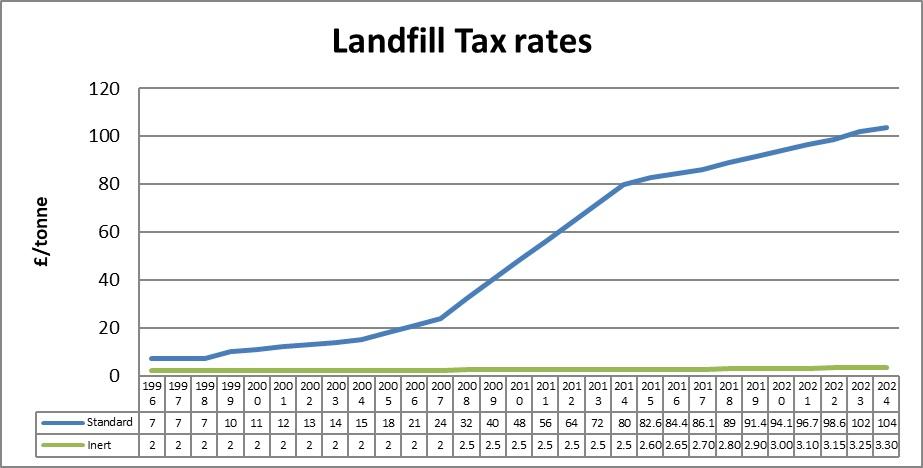

The Standard Rate Landfill tax rises each year on an escalator that is set by the Chancellor in his Budget. Both rates now increases at RPI rounded to the nearest 5 pence, taking the Standard Rate to £103.70 from 1 April 2024 and the Inert rate to £3.30.

The table shows the two rates of tax from when they started in 1996 to 2024. In each year, these change to the rate shown on 1 April.

Statistics

Since January 1998, the Treasury has received approximately £18bn in tax receipts.

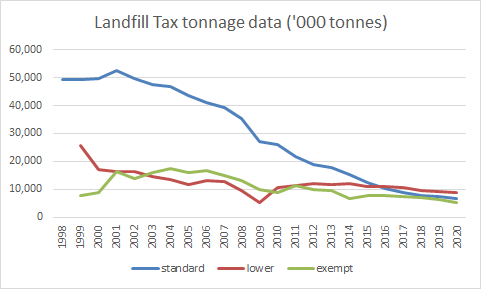

Tonnages have been dropping over the years, especially since the £8/tonne increase came in for the first time in 2008. The graphs below show annual tonnage inputs since 1999 and the quarterly inputs over the last three years. However, the two graphs also illustrate how, in the last couple of years, increases in the amount being landfilled as inert lower rate or as exempt have been fairly flat. Concerns have been raised as to whether waste is being mis-described to avoid the full tax, especially as these number are hugely less than those published by the EA.

On average, a 1100 litre wheely bin of waste weighs approximately 65kgs. This will mean that if it all goes to landfill, HMRC – who administer the tax – will collect £6.41 at the 2022/23 rate of £98.60/tonne.

Inert and exempt inputs

Following a ruling in 2009 when HMRC was forced to rebate £300m in tax that had been paid on waste used for engineering purposes, new regulations were put in place to restrict what could be used for engineering without paying tax. The Landfill Tax (Prescribed Landfill Site Activities) Order 2009 ensured that most engineering activities were liable.

Further regulations were then published in 2011 that specified the type of material that could be classed as inert waste, attracting the lower rate of tax. Of particular note was the exclusion of topsoil. The Landfill Tax (Qualifying Material) Order 2011 allowed a degree of non-inert contamination, but guidance issued by HMRC on 18th May 2012 tightened up that position and stated that treated waste from transfer stations – fines and screenings – should all be classed as standard rate liable as it cannot be determined that they will not contain standard rate materials.

HMRC stress that this Guidance has simply clarified their position as there had been concerns expressed by larger waste companies that the rules were being flouted allowing standard rate material to be landfilled at the lower rate of tax, thereby providing an unfair commercial advantage. However, a strong reaction by some parts of the waste industry had led to further clarification which allows fines from inert materials to still be landfilled as inert waste.

New Regulations have now been produced that apply a ‘Loss of Ignition’ Test to determine whether waste qualifies for the lower rate. In simple terms, if waste loses more that 15% of its weight during a heating process (falling to 10% from April 2016), it does not qualify although it appears that HMRC are now revisiting this.

Landfill Communities Fund

When the tax started, landfill operators were allowed to use 20% for environmental good causes, enabling thousands of local and national projects to be funded to increase recycling, improve the built environment and aid R&D. A few years back, the government decided to change this by allocating part of the fund themselves to specific causes – WRAP, for instance – to provide a more foicussed approach. The percentage available to landfill operators has dropped to 6.8% in 2013/14 which in 2012/13, was around £65m. Enrolled bodies have to be registered through Entrust to apply for this money although the criteria for application is now fairly limited.